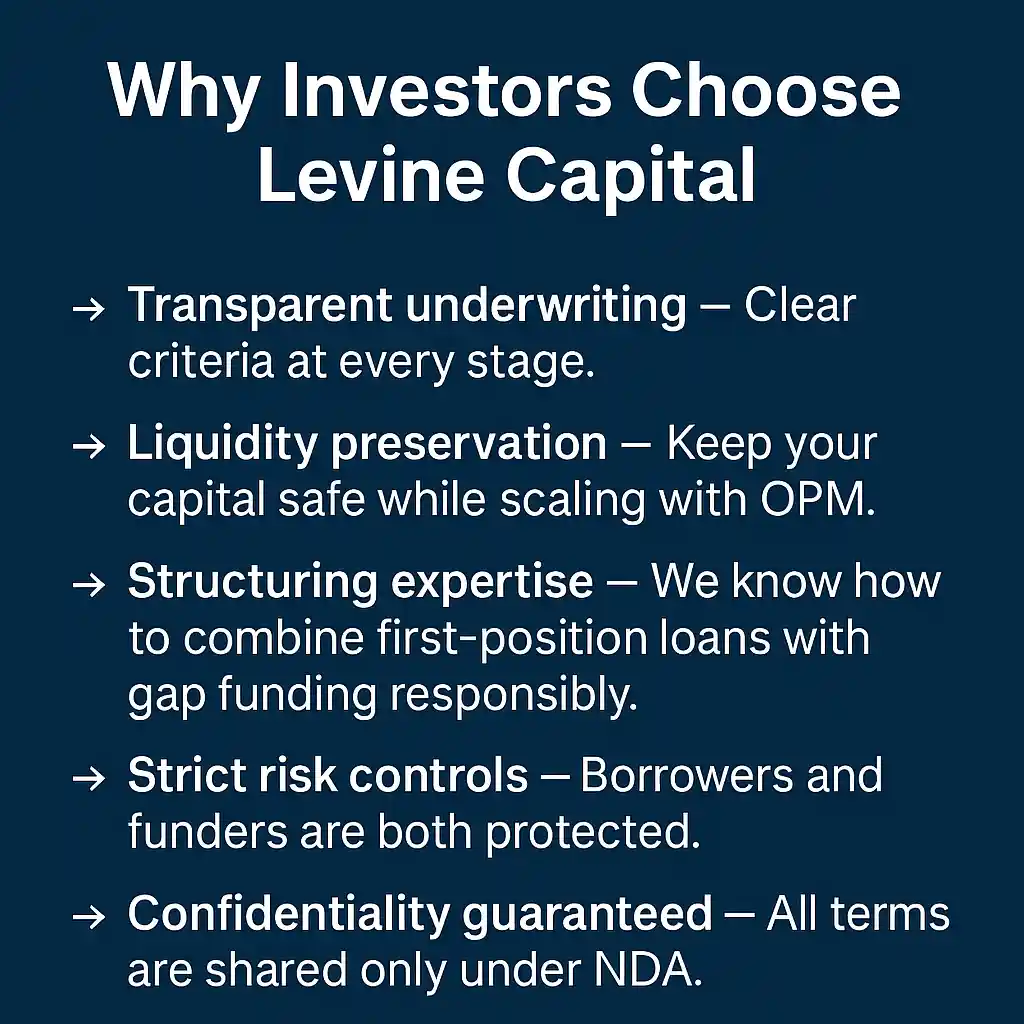

At Levine Capital, we don’t just provide capital—we structure deals to win. Our underwriting process is designed to protect borrowers, gap funders, and senior lenders, while allowing investors to scale using Other People’s Money (OPM) without draining their own liquidity.

Gap funding is powerful, but it must be done responsibly. Below is exactly how we underwrite and structure every deal.

1. Loan-to-Value (LTV) & Loan-to-Cost (LTC)

-

Max Combined LTV (Hard Money + Gap): 70% of ARV.

-

First Position Loan: Up to 95% LTC (purchase + rehab).

-

Gap Funding (Second Position): Can push the deal above 95% LTC, but combined leverage can never exceed 70% ARV.

-

To go above 70% ARV, we require cross-collateral that meets strict standards.

-

In select cases, we may structure 100% purchase + rehab financing if equity protection is strong.

2. Cross-Collateral Integration

Cross-collateral is a key underwriting tool we use to strengthen deals. It can:

-

Offset borrower equity requirements.

-

Support higher leverage when a project has strong fundamentals.

-

Mitigate risk on files with weaker credit or limited experience.

Requirements we enforce:

-

Clear title.

-

Minimum 25% equity in the pledged property.

-

Valuation supported by BPO or appraisal (≤ 90 days).

📌 Submission Requirement: Investors must provide a Real Estate Owned (REO) Schedule when submitting a loan. This allows our underwriting team to identify cross-collateral opportunities upfront.

3. Borrower Standards

-

Credit Score: Ideally 680+ FICO when gap funding is included.

-

We will consider scores as low as 620 on a case-by-case basis with compensating factors.

-

-

Soft Credit Pulls: Our process uses soft inquiries only—no impact on your credit score.

-

Experience: 1+ completed flips in the past 24 months is preferred.

-

First-time flippers: We allow them under strict conditions, including:

-

Detailed rehab plan,

-

Verified contractor bids, and

-

A contingency budget of at least 10% of project cost.

-

4. Property Standards

-

Location: We underwrite for urban and suburban markets with strong comps.

-

Valuation: ARV must be supported by recent sales within 1 mile and 6 months.

-

Scope: Rehab timeline and budget must align with market norms.

-

Eligible: 1–4 unit residential (select mixed-use/multifamily considered).

5. Funding Structure (Our Approach)

We break the deal into three parts:

-

Hard Money Loan (1st Position): Up to 95% LTC (purchase + rehab).

-

Gap Funding (2nd Position): Equity shortfall covered, but total leverage remains ≤70% ARV unless supported by cross-collateral.

-

100% Financing: Offered selectively where equity protection exists (low ARV leverage or strong collateral).

⚠️ Confidentiality Notice:

To protect our lenders and funding partners, all counterparties must sign an NDA before we disclose any gap funding terms, pricing, or structures.

6. Reserves & Liquidity

Our underwriting requires proof of strength from borrowers:

-

Minimum 3 months of interest reserves.

-

Verified liquidity for soft costs and overruns.

-

Acceptable documentation includes bank statements, brokerage accounts, or verifiable cash.

7. Exit Strategy Requirements

Every deal must have a defined exit:

-

Primary Exit: Resale within 12 months.

-

Backup Exit: Must be verifiable, such as:

-

Pre-approved DSCR refinance, or

-

Rental stabilization plan with property management in place.

-

8. Valuation Process

We validate ARV and scope with:

-

Licensed third-party appraisals, or

-

Internal BPO + contractor budget review.

Both as-is value and rehab budget must align with market conditions.

9. Risk Mitigation for Funders

Gap funding often sits in second position, which adds risk. Our structuring process reduces that risk by:

-

Enforcing a 70% ARV max leverage cap.

-

Requiring borrower reserves and contingency funds.

-

Relying on independent valuations and contractor reviews.

-

Protecting all deal terms under strict NDA agreements.

👉 At Levine Capital, underwriting and structuring are what set us apart. We don’t just provide money—we design deals that make sense for everyone involved.

📌 Ready to scale your Fix & Flip portfolio with OPM? Submit your deal through our Quick Quote form. Include your REO Schedule, and we’ll structure the right solution—under NDA protection.