Capital Stack: Senior Debt, Mezzanine Debt, Preferred Equity, Common Equity

Capital and financing for businesses and investments have been expanding with a wider array of options, features, and strategies. Knowing how these types of money fit together can help investors better understand what they are getting into, the best type of debt or private equity investment to make for their own personal situation, and how […]

Where 2021 is Taking the Real Estate Market?

What’s next for the U.S. real estate market in 2021? What should real estate investors expect from the property sector in the months ahead? How might that influence the best investments to be made? The Wildcards For years, we’ve been told that the theme of the year is uncertainty. While there may still be some […]

Investor Story: How I Got Into Investing, By Adam Levine

I learned to invest (and how not to invest) at a relatively early age. These are some of the biggest lessons I’ve learned from real estate investing over the years, and that I believe everyone can benefit from learning sooner, by watching others, rather than by expensive personal trial and error. The Back Story Growing […]

Multifamily Vs. Single Family Investing

Which is better, single-family or multifamily investing? There are clear similarities between these two real estate sectors. Yet, there are also significant differences as well. Some see single-family rentals as an investment for getting your feet wet and working up to multifamily. Others have found success in skipping right to multifamily investing. Both are very […]

Levine Capital Newsletter June 2021

Real Estate Update June 2021 Find out what’s happening in the market now, what’s driving trends and investor choices, as well as the latest updates from Levine Capital… The State Of The Markets Key factors at play right now… Capital Is Plentiful Investors have been stockpiling cash over the past year. This includes everyone from […]

The Benefits of Private Real Estate Investing

What are the advantages of private real estate investments? Private real estate investors enjoy many benefits over their peers who are solely invested in such conventional investment vehicles as stock and bonds. Once they’ve tasted the respectable risk-adjusted results, none ever wants to look any further. What Is Private Real Estate Investing? The traditional way […]

Real Estate Investing: Why The Smart Money Loves Income Properties

The biggest and brightest money has always loved real estate investing in income properties. That has been true since medieval times. It is true today, and it isn’t changing. Billionaires, sovereign funds, corporations, and big investment firms all prize income property investing. It’s what has made the financial difference for many individuals and families and […]

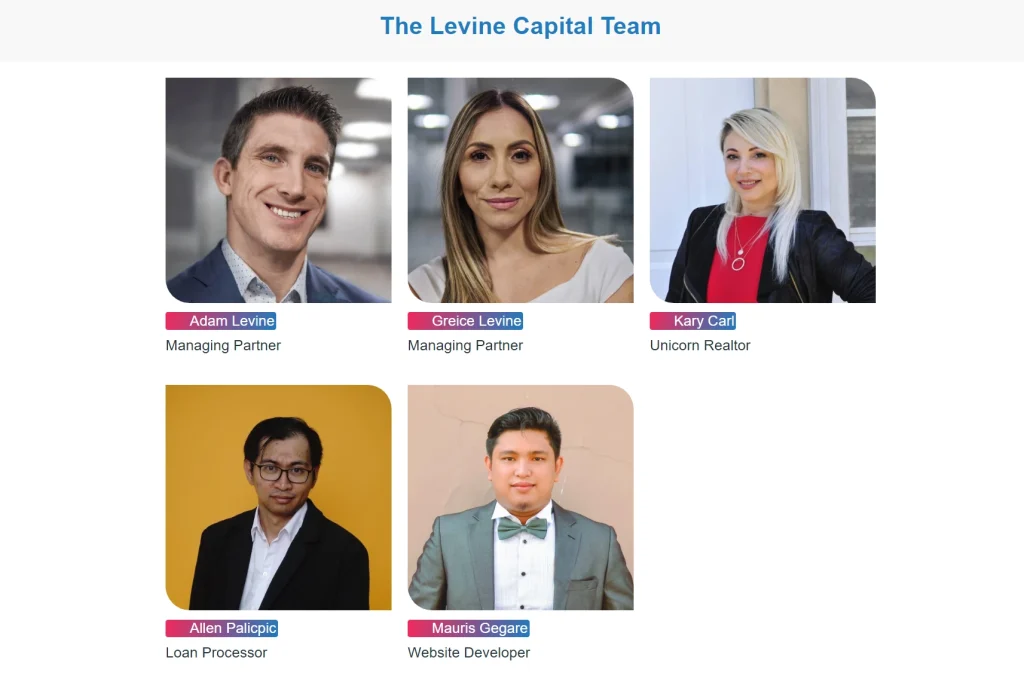

5 Things You Should Know About Levine Capital

So, you’re interested in investing with Levine Capital. What should you know about us before investing? We are big believers in knowing who you are investing with. In fact, it is probably the most important part of any investment decision you ever make. We like to make real estate investing easy, but we also want […]

Investing With Dr. Stewart Levine

I’m here today with my father and mentor, Dr. Stewart Levine. I want to share the valuable knowledge that he’s shared with me. Everything from sports and wrestling moves to hiring personal tutors and sharing valuable life lessons with me. Along with the valuable life skills he shared with me, he’s motivated me to invest […]

Levine Capital Newsletter May 2021

Real Estate Update May 2021 Find out what’s happening in the market, what’s driving trends and investor choices, as well as the latest updates from Levine Capital… The State Of The Markets It is certainly an interesting time in the world. We have been through a series of almost unprecedented events over the past year. […]